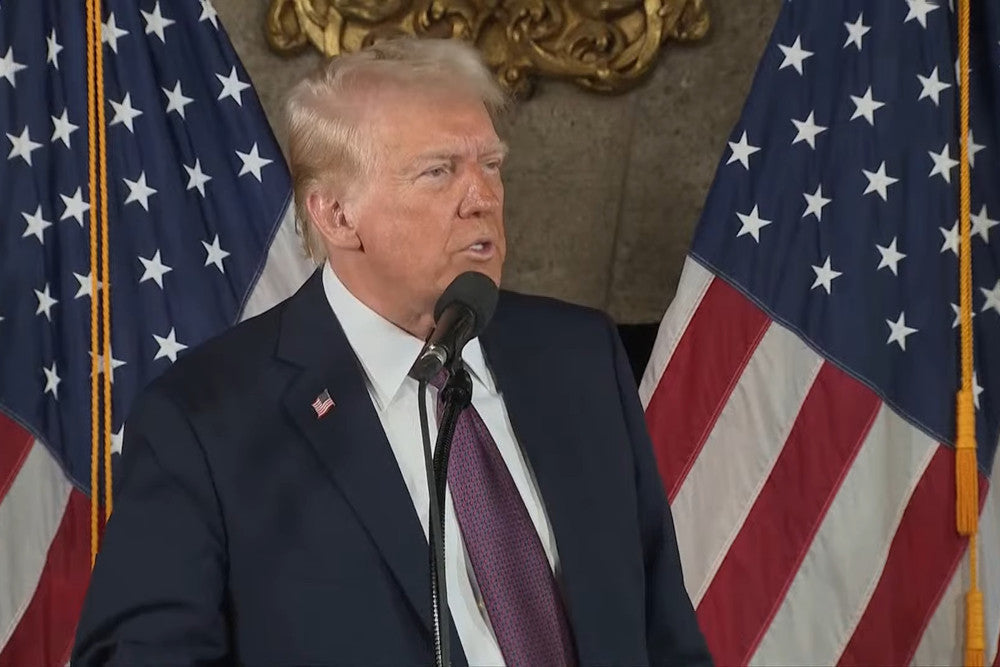

n a dramatic escalation of international trade tensions, U.S. President Donald Trump has announced that tariffs on the European Union will "definitely happen," signaling a continuation of his aggressive trade policy that has already seen tariffs imposed on Canada, Mexico, and China. This statement was made in the context of ongoing global economic turmoil, as markets react to what is increasingly being perceived as the onset of a global trade war.

The Trump Tariff Strategy

President Trump's approach to international trade has been characterized by a protectionist stance, aiming to reduce the U.S. trade deficit by imposing tariffs on imports. His latest statements regarding the EU come after he implemented a 25% tariff on goods from Canada and Mexico, and a 10% tariff on Chinese goods. Trump justified these measures by citing the need to address illegal immigration, drug trafficking, particularly fentanyl, and to rectify what he describes as unfair trade practices by these nations.

Trump's comments on the EU were particularly stark. He described the trade deficit with the EU as an "atrocity," emphasizing that the bloc takes "almost nothing" while the U.S. imports "everything" from them. This rhetoric aligns with his campaign promises to renegotiate trade deals to favor U.S. interests, highlighting a persistent theme of his administration's economic policy.

Impact on the UK

The UK, in the midst of navigating its post-Brexit trade relationships, finds itself in a precarious position. Trump has labeled the UK as "out of line" in international trade but suggested that any outstanding issues could potentially be resolved without resorting to tariffs. This stance was somewhat reassuring for UK Prime Minister Sir Keir Starmer, who has been engaging in direct communication with Trump, aiming to secure a beneficial trade deal with the U.S.

However, the broader implications for the UK are fraught with uncertainty. The threat of tariffs from the U.S. could undermine the UK's economic recovery post-Brexit, especially given its reliance on trade with both the U.S. and the EU. The FTSE 100, a barometer for UK economic health, experienced significant drops in early trading sessions following Trump's tariff announcements, reflecting investor fears over a prolonged trade conflict.

Global Market Reactions

The global financial markets have not taken kindly to the news of escalating trade tensions. Asian markets tumbled early in trading, with significant drops in major indices reflecting a fear of a broader trade war. European markets followed suit, with particular concern for car manufacturers whose supply chains are deeply integrated across continents. The threat of tariffs on EU goods could disrupt these chains, leading to higher costs, reduced production, and potential job losses across the sector.

The U.S. dollar saw a surge, often a sign of capital flight to safe-haven currencies during times of economic uncertainty. However, this could also reflect a short-term confidence in U.S. economic policy, despite the long-term risks posed by trade wars.

Retaliation and Countermeasures

In response to Trump's tariffs, both Canada and Mexico have announced retaliatory measures. Canada's Prime Minister Justin Trudeau has pledged not to back down, announcing tariffs on a range of American products from alcohol to household appliances. Mexico, under President Claudia Sheinbaum, has similarly threatened retaliatory tariffs but with a call for continued dialogue to mitigate escalation.

China, while more measured in its public response, has criticized the U.S. actions as violations of WTO rules and has moved to file complaints with the World Trade Organization. The Chinese commerce ministry has warned that there are no winners in a trade war, emphasizing the potential for mutual damage.

The EU, bracing for potential U.S. tariffs, has warned of a "firm response" if the U.S. goes ahead with its threats. European leaders, including German Chancellor Olaf Scholz, have underscored the importance of open markets and international trade rules, hinting at potential counter-tariffs or other economic measures to protect EU interests.

Economic and Political Analysis

Economists are sounding alarms about the potential for these tariffs to lead to a broader economic slowdown or even a recession if not managed carefully. The ripple effects could include increased prices for consumers, disrupted supply chains, and a significant hit to global trade volumes. The argument from Trump's administration that these tariffs could benefit the U.S. by encouraging domestic production and reducing reliance on foreign goods is met with skepticism by many experts who warn of the retaliatory measures and the overall cost to global economic health.

Politically, Trump's aggressive trade policy is a double-edged sword. While it appeals to his voter base who support protectionism, it risks alienating key allies and could complicate international relations at a time when global cooperation is needed on numerous fronts, including climate change, security, and pandemics.

Looking Forward

The immediate future seems set for further negotiations or escalation. Trump has hinted at potential talks with leaders from Canada and Mexico, suggesting there might be room for dialogue. However, the nature of these discussions will be critical in determining whether the tensions can de-escalate or if they will spiral into a more severe economic conflict.

For the EU and UK, the strategy appears to be one of careful navigation, with leaders advocating for a rules-based international trade system while preparing for various scenarios, including retaliation. The UK, in particular, must balance its negotiations with the U.S. with its ongoing relationship with the EU, which remains its largest trading partner.

In conclusion, Trump's latest statements on tariffs with the EU and his warnings to the UK have set the stage for a complex and potentially damaging series of economic interactions. The global community watches closely, hoping for a resolution that avoids further economic disruption but prepared for a long and possibly contentious road ahead. This trade war, if it intensifies, could redefine global economic alignments, challenge the WTO's role, and test the resilience of the world's economies in ways not seen in recent decades.

War dieser Artikel hilfreich für Sie? Bitte teilen Sie uns in den Kommentaren unten mit, was Ihnen gefallen oder nicht gefallen hat.

About the Author: Alex Assoune

Wogegen Wir Kämpfen

Weltweit-Konzerne produzieren in den ärmsten Ländern im Übermaß billige Produkte.

Fabriken mit Sweatshop-ähnlichen Bedingungen, die die Arbeiter unterbezahlt.

Medienkonglomerate, die unethische, nicht nachhaltige Produkte bewerben.

Schlechte Akteure fördern durch unbewusstes Verhalten den übermäßigen Konsum.

- - - -

Zum Glück haben wir unsere Unterstützer, darunter auch Sie.

Panaprium wird von Lesern wie Ihnen finanziert, die sich unserer Mission anschließen möchten, die Welt völlig umweltfreundlich zu gestalten.

Wenn Sie können, unterstützen Sie uns bitte monatlich. Die Einrichtung dauert weniger als eine Minute und Sie werden jeden Monat einen großen Beitrag leisten. Danke schön.

0 Kommentare